Established in 2009, Janchor is a long-term Industrialist Investor. We partner with companies that have superior business models, favourable growth prospects and the potential to be part of positive structural dynamics of Asian countries and economies. As a genuine thought partner, Janchor builds deep relationships with investee companies and helps to increase long-term corporate value.

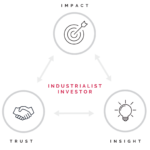

Janchor’s mission is to have a lasting impact by building insight and trust. We search for positive potential, adopt a transparent “all cards on the table” mindset and aim to identify sustainable pathways. By openly sharing our work, we build mutual trust that enables us to develop a deeper understanding, which empowers us to make better investment decisions and give back to those around us. Ultimately, we seek to make a positive impact on others as well as achieving better investment results for our partners.

Our Investment Philosophy

Concentrated Portfolio

In constructing the portfolio, we seek out companies with high business model visibility and the ability to deliver solid, long-term IRR. These investments do not exist in abundance, so we size them up to make each of our investments substantial and relevant. We believe the best way to produce solid, long-term returns is to concentrate in the most visible ideas while limiting turnover in the portfolio, and letting time do the work of compounding the earnings power of the businesses we invest in.

Bottom-Up Focus

Each of our portfolio investments has a stand-alone investment thesis that is bottom-up in nature and independent from other investments. While macro and sentimental factors tend to drive stock price performance in the short term, they will even out over time. We believe companies with superior business models and capable management will find ways to navigate top-down macro challenges and perform well over the cycle regardless. As a result, we invest in companies primarily with a bottom-up focus.

Deep Research

We see high quality, differentiated research as essential for sustainable alpha generation. We work incessantly to uncover insights into how businesses and industries work over time, which anchors our investment thesis. A key pillar of our investment process is deep and constant on-the-ground research. We seek and develop new ways to learn about companies, consumers and industries through a differentiated point of view. We partner with management and industry participants to test and improve our understanding in an ongoing process, which enables us to build high conviction in our investments.